The US Government began a partial shutdown on October 1st, potentially putting up to 1 million workers on unpaid leave, closing national parks and stalling medical research projects. While those things are all saddening and will affect many individuals and families, it is important to keep your eyes on the horizon, especially if you are asking yourself what the shutdown means to your investment portfolio.

The important thing to remember during good news, or bad, is to stay disciplined to your financial plan. No one knows for sure how the market will react to the most recent federal government closure. Will this be short-lived or turn into another crisis? No one knows for certain. For what it’s worth, the S&P 500 added 0.1 percent during the federal shutdown from December 15th, 1995 to January 6th, 1996. During the November 13th to November 19th, 1995 closure, the S&P 500 rose 1.3 percent. The point in showing those numbers isn’t to suggest the market will advance in the coming days, but to see if you remembered the last time the federal government put up the “not open” sign. Chances are you forgot it was 17 years ago. And chances are you will forget this similar blip on the radar fifteen years from now.

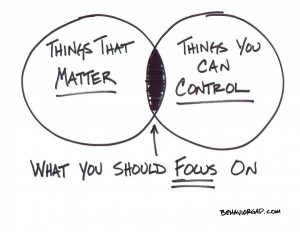

As always, it is crucial that investors focus on the things they can control when it comes to their investment portfolio like risk, costs and taxes; and not get caught up in the inevitable daily ups and downs of the news and markets.