A recent conversation with a client reminded me that investors should stop looking for the perfect investment – it doesn’t exist. No matter your financial goals and concerns, there is always going to be risk associated with any financial decision you make. You simply have to identify the risks you are willing to accept.

If someone were to decide to put their life savings under their mattress, they would assume the risk of their money burning in a fire. While that risk might be remote, it does exist. Investors should never treat the highly unlikely as impossible.

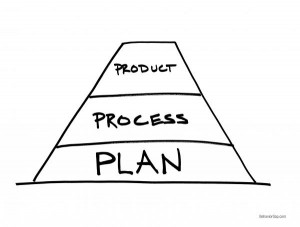

While the types of investments you choose has an impact on your financial future, it is just as important (if not more) to focus on more fundamental money issues. For example, does it make sense to contribute to your 401(k) while carrying a 19% credit card balance? There is no right answer for everyone, just one right answer for you. If you don’t know the answer yourself, work with someone you trust to help you find the answer. This should eventually lead you to having a financial plan. Plan first, investments second. Not the other way around.